Financial Consulting

The go-to, trusted Financial Advocates

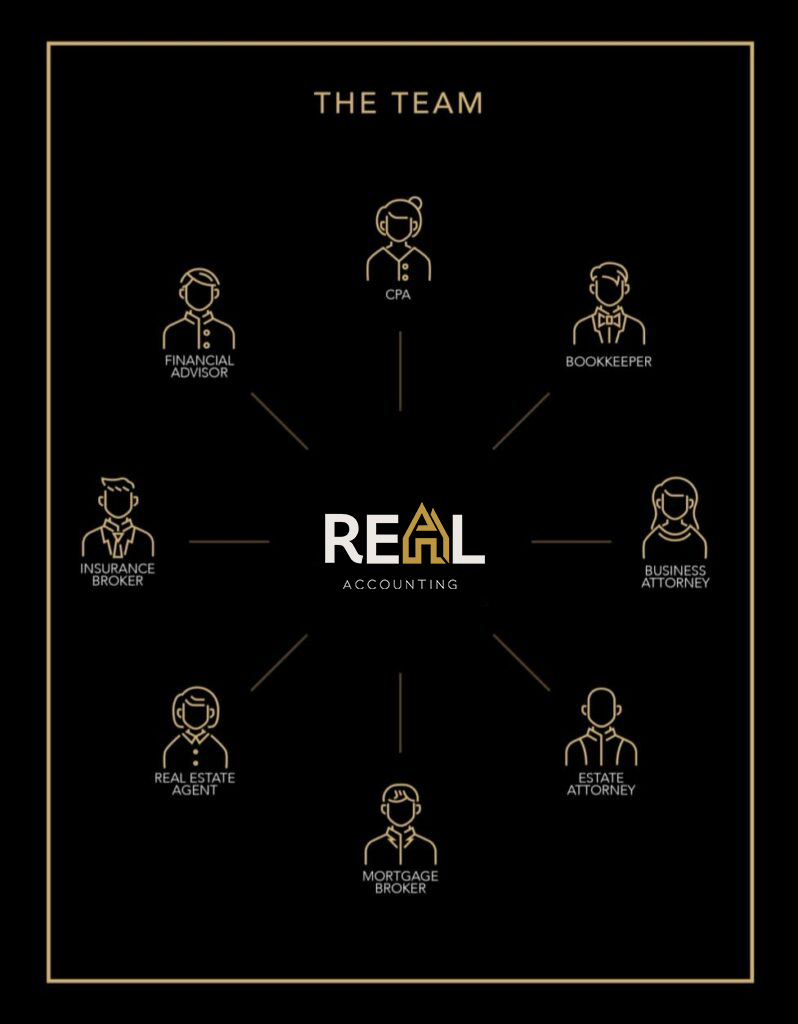

We sit in the center hub our clients financial world

We bring the breathe of our experience and industry knowledge to help you succeed

People get financial information from all corners, colleagues, parents, friends, business partners etc. A CPA tries to lower your taxes and income but a mortgage broker wants to have you show income to get approved for a house. Who is right? With many advisors giving information in silos, which options are right for YOU? With our financial consulting package, we truly sit in the center of your financial world and are able to make sure what you are doing is truly in alignment with what you want.

This is where we truly become the center hub of our clients financial world. In a world full of information at our fingertips it can be very overwhelming at times. There are advisors all over giving out information, from CPA’s, Financial Advisors, Mortgage Brokers, Insurance Brokers, Realtors, Business owners, Attorneys, but who is right? Most likely all of them are right in their own accord.

We have found a way to virtually bring them all in the same room with our Financial Consulting package. First we need to get a starting point. Our first meeting is what we call a Financial MRI. This is where we collect a high overview of all your financial data from, insurance, wills/trusts, investments, debts, cash flow, tax returns etc. This is the first key to your financial success. How can you make a confident decision without first understanding what you have, why you have it and if its aligned with what you want?

Now that we have the data we stick to our proven process. We start with a protection review first. What good is it to make tons of money and grow your business if it could all be gone in a day? There are tremendous threats to our businesses and finances. We create protection strategies that maximizes your future while radically reducing the potential for failure, ultimately assuring the results.

Now that our clients have ultimate protection, it frees us up to focus on the more fun topics. The first one being Cash Flow. We created a cash flow model that puts our clients in an optimal position to consistently make exceptional decisions. The compounding effect of consistently making wise decisions has a tremendous impact to our client’s bottom line. Cash flow is king.

Next step is Wealth Accumulation. There are many ways to generate wealth. Real estate investment properties, investments, retirement accounts, owning multiple businesses, Airbnb’s and more. Which is the right one for you? We can run all types of scenarios for our clients to see what will happen to their full balance sheet if they go one way or the other. One decision will effect many other categories on the balance sheet, so we make sure our clients know ALL options.

Our final step is UNECESSARY debt elimination. We believe debt can be a great tool in building wealth. There is a difference between good debt and bad debt. We help our clients strategically leverage debt if it makes sense for them.

Once a client has completed the process, we continue to update their balance sheet as their financial journey continues. We believe all our clients are very smart, people just don’t know what they don’t know. Our main objective is to provide guidance and options for our clients to make optimal decisions with their money to achieve their financial goals.